Clark Wealth Partners Things To Know Before You Buy

Clark Wealth Partners Fundamentals Explained

Table of ContentsExamine This Report about Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedClark Wealth Partners for BeginnersOur Clark Wealth Partners PDFs

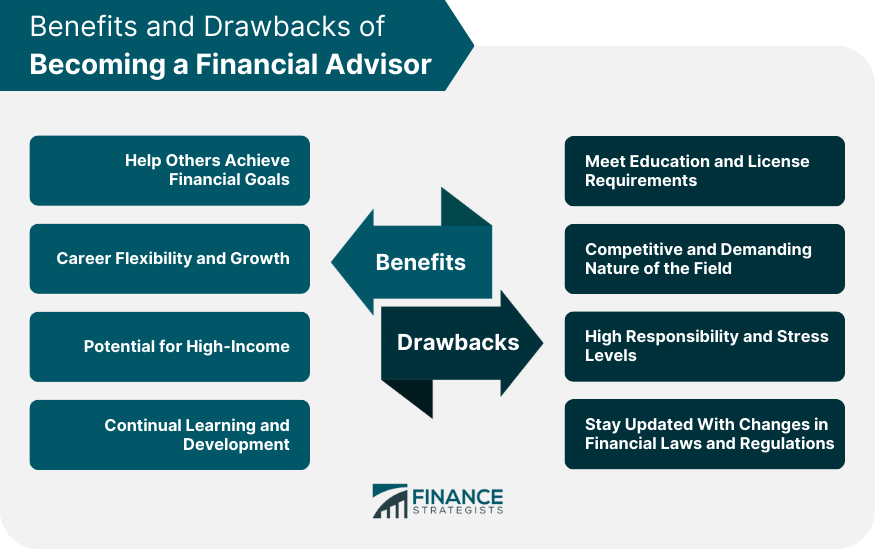

Purpose to discover an advisor whose charge framework you're comfortable with and with whom you feel you can deal with long term. financial company st louis. Below are the benefits and drawbacks of employing a monetary consultant and the essential things you need to understand. Pros Cons Can provide a comprehensive approach based upon your requirements May have expensive and confusing costs Can give clarity and help you stick to your plan Certifications might be challenging to veterinarian Can take care of portfolio monitoring for you Not every financial advisor will be the appropriate fit for you Monetary advisors concentrate on developing a detailed technique that can cover several elements of your life, consisting of financial investment, insurance, estate preparation and moreA good consultant also pays attention to your demands and crafts a method tailored to your needs. They work as a "job supervisor" for your total strategy, says Beloved Henderson, RICP, creator of RichLife Advisors in Gainesville, Georgia. That includes financial investments but likewise Medicare, long-lasting treatment and Social Safety. Show up with your program and what you desire, he claims - https://bizz-directory.com/gosearch.php?q=https%3A%2F%2Fwww.clarkwealthpartners.com%2F&search-btn2.x=32&search-btn2.y=1.

In good times, it's simple to create a plan and commit to it. When times obtain difficult, individuals frequently desire to deviate from a plan that can guide them through and rather choose for what feels mentally risk-free or safe and secure.

"One of the most crucial point a person should know prior to engaging a monetary consultant is that they must choose a fiduciary expert," states Faro (financial advisors Ofallon illinois). "As a fiduciary, an expert is required to offer guidance that is in their clients' best interests, even if that requires recommending a less costly financial investment alternative or declining a payment," he claims

All about Clark Wealth Partners

"A good expert can help actionize your great purposes." Financial advisors earn money in different means. Some bill a per hour charge. Others bill a cost that's based on the properties they have under administration. But as a customer, this is something you require overall clearness on from your consultant. "It is vital to understand all fees and the structure in which the consultant runs," claims Cast.

Spoiler: You can easily pay tens of thousands over a job. Some economic advisors may have few or no credentials, having just hung up a tile and called themselves an expert. Customers do have sources to trim down the field before performing more research study into a consultant.

The 9-Second Trick For Clark Wealth Partners

"It's commonly hard for possible customers to carry out proper due persistance on experts in development, and the industry does an excellent task of running ads on television and radio that make all firms seem alike, but they are not," states Kujawa. Below are 5 essential concerns to ask any prospective financial advisor prior to you start collaborating with them.

Not all consultants are experts in every subject, though they might be good generalists. You require an advisor that has the knowledge or who can call in other professionals to do what you need done.

The pros and cons, prospective clients require to comprehend a variety of things concerning hiring an economic consultant, state the experts., it's essential to know what you want because that will shape who you pick.

Clark Wealth Partners Things To Know Before You Get This

While it can be easy to neglect, your economic expert will have accessibility to one of the most sensitive areas of your life. That implies checking out any type of potential expert for fit and making certain they're going to do what you need them to do.