The Only Guide to Clark Wealth Partners

The Ultimate Guide To Clark Wealth Partners

Table of ContentsClark Wealth Partners for BeginnersThe Ultimate Guide To Clark Wealth Partners5 Simple Techniques For Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Need To KnowClark Wealth Partners - The FactsFascination About Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyTop Guidelines Of Clark Wealth Partners

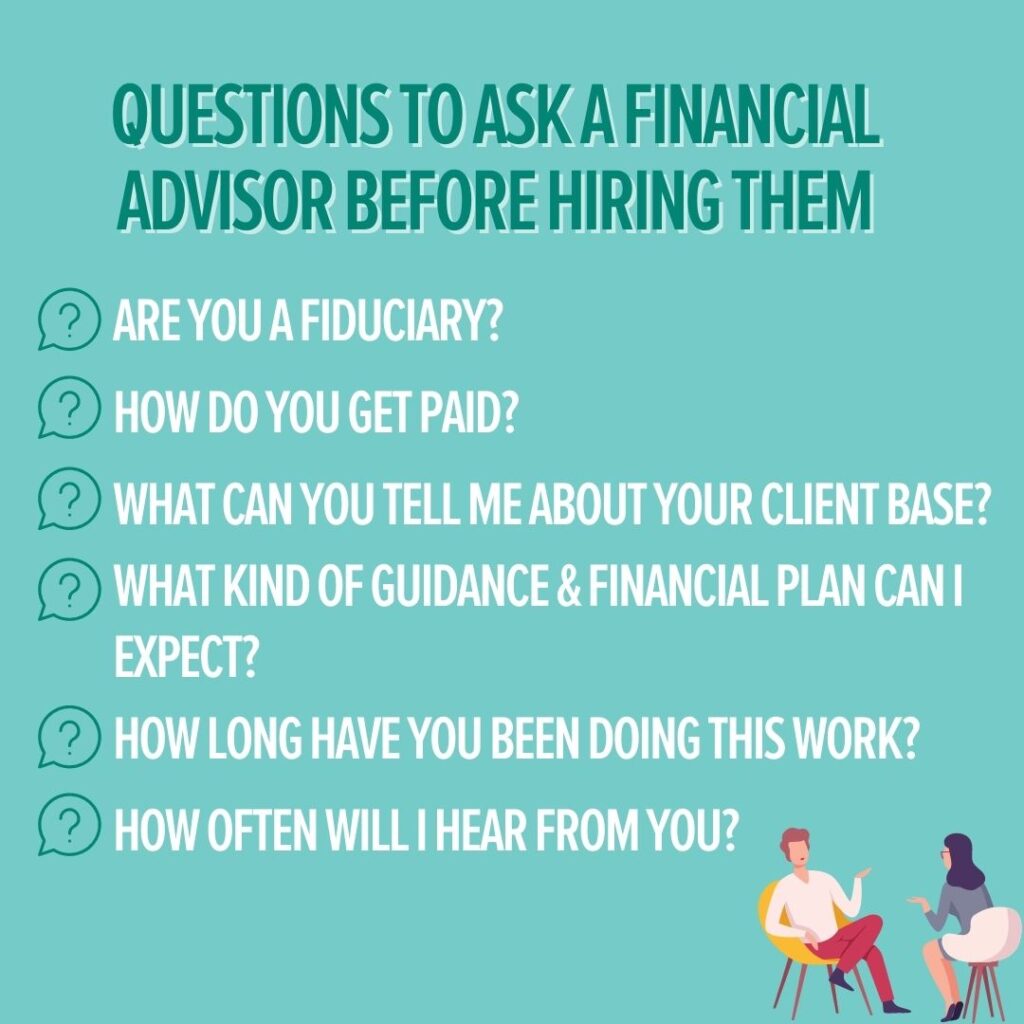

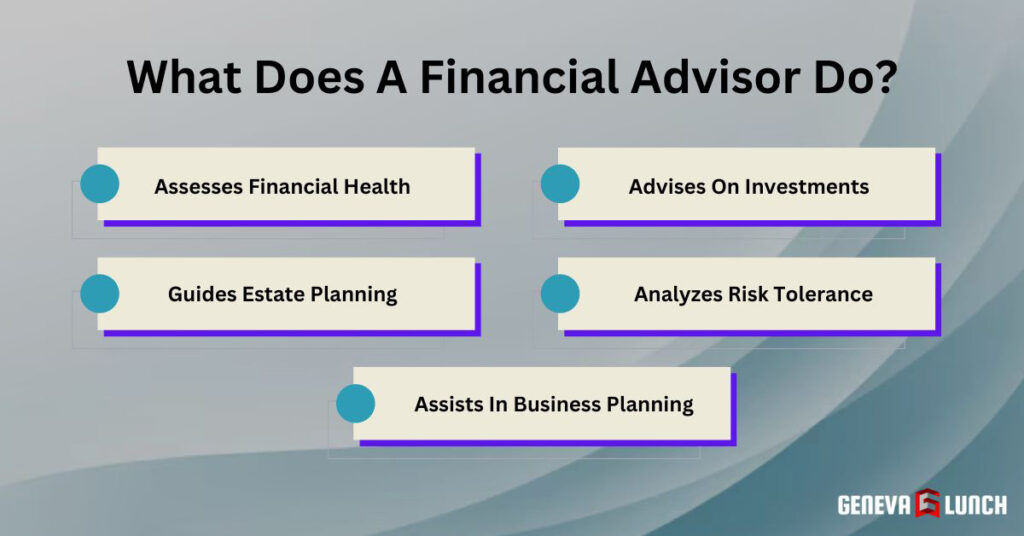

Typical reasons to consider a monetary consultant are: If your monetary circumstance has actually ended up being a lot more complex, or you do not have confidence in your money-managing abilities. Conserving or navigating significant life events like marriage, divorce, youngsters, inheritance, or work change that may dramatically influence your financial circumstance. Browsing the change from conserving for retirement to protecting wealth throughout retirement and just how to create a solid retirement income strategy.New technology has actually led to even more thorough automated economic devices, like robo-advisors. It's up to you to investigate and identify the appropriate fit - https://www.pearltrees.com/clrkwlthprtnr#item764008498. Ultimately, a great monetary advisor should be as mindful of your financial investments as they are with their own, avoiding extreme charges, conserving cash on tax obligations, and being as transparent as possible about your gains and losses

How Clark Wealth Partners can Save You Time, Stress, and Money.

Making a payment on item suggestions does not always suggest your fee-based consultant antagonizes your benefits. But they may be extra likely to suggest product or services on which they earn a commission, which might or may not remain in your benefit. A fiduciary is lawfully bound to place their client's passions initially.

They might follow a freely kept track of "viability" criterion if they're not registered fiduciaries. This standard enables them to make referrals for investments and services as long as they suit their customer's objectives, threat tolerance, and financial circumstance. This can convert to suggestions that will certainly also make them cash. On the various other hand, fiduciary consultants are legally obliged to act in their customer's finest rate of interest rather than their own.

Not known Factual Statements About Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving into complicated monetary topics, losing light on lesser-known financial investment opportunities, and revealing methods visitors can function the system to their advantage. As an individual finance expert in her 20s, Tessa is really familiar with the influences time and uncertainty carry your financial investment choices.

It was a targeted advertisement, and it functioned. Review more Review much less.

An Unbiased View of Clark Wealth Partners

There's no solitary course to coming to be one, with some individuals starting in financial or insurance, while others begin in bookkeeping. A four-year level supplies a strong structure for careers in investments, budgeting, and customer solutions.

All About Clark Wealth Partners

Typical examples consist of the FINRA Collection 7 and Series 65 examinations for safety and securities, or a state-issued insurance policy permit for marketing life or medical insurance. While qualifications may not be legally needed for all planning duties, employers and customers typically see them as a standard of expertise. We look at optional qualifications in the following section.

A lot of economic coordinators have 1-3 years of experience and familiarity with monetary items, conformity criteria, and straight customer interaction. A solid academic background is important, but experience demonstrates the ability to apply theory in real-world setups. Some programs integrate both, allowing you to complete coursework while making supervised hours through internships and practicums.

See This Report about Clark Wealth Partners

Several enter the field after operating in banking, accounting, or insurance policy, and the change needs determination, networking, and typically sophisticated credentials. Early years can bring long hours, stress to construct a client base, and the need to consistently confirm your expertise. Still, the occupation uses strong lasting potential. Financial organizers take pleasure in the chance to function very closely with customers, overview important life decisions, and commonly accomplish flexibility in routines or self-employment.

Riches supervisors can enhance their revenues via payments, possession fees, and efficiency bonuses. Monetary supervisors oversee a group of financial organizers and advisers, setting department approach, handling compliance, budgeting, and guiding interior procedures. They invested much less time on the client-facing side of the sector. Virtually all monetary supervisors hold a bachelor's level, and lots of have an MBA or comparable academic degree.

5 Simple Techniques For Clark Wealth Partners

Optional accreditations, such as the CFP, generally call for added coursework and screening, which can expand the timeline by a number of years. According to the Bureau of Labor Statistics, personal monetary experts earn a typical yearly yearly income of $102,140, with leading income earners gaining over $239,000.

In various other districts, there are regulations that need them to meet specific demands to use the monetary expert or monetary organizer titles. For financial organizers, there are 3 typical classifications: Licensed, Personal and Registered Financial Coordinator.

The Best Guide To Clark Wealth Partners

Those on wage might have a motivation to advertise the products and solutions their companies provide. Where to discover a financial expert will depend on the sort of recommendations you require. These establishments have staff who may help you understand and get specific kinds of investments. As an example, term down payments, ensured financial investment certificates (GICs) and common funds.